California employers face one of the most employee-friendly laws of any state in the US. Among those, the California minimum wage law is one of the most generous to employees in the country. With the potential for annual adjustments and business pressures from unexpected events like the 2020 COVID-19 pandemic, minimum wage compliance is a moving target. To avoid California minimum wage claims and be competitive in the marketplace, California employers need to understand when and how the law applies to them.

Employers Avoid California Minimum Wage Claims by Following the Law

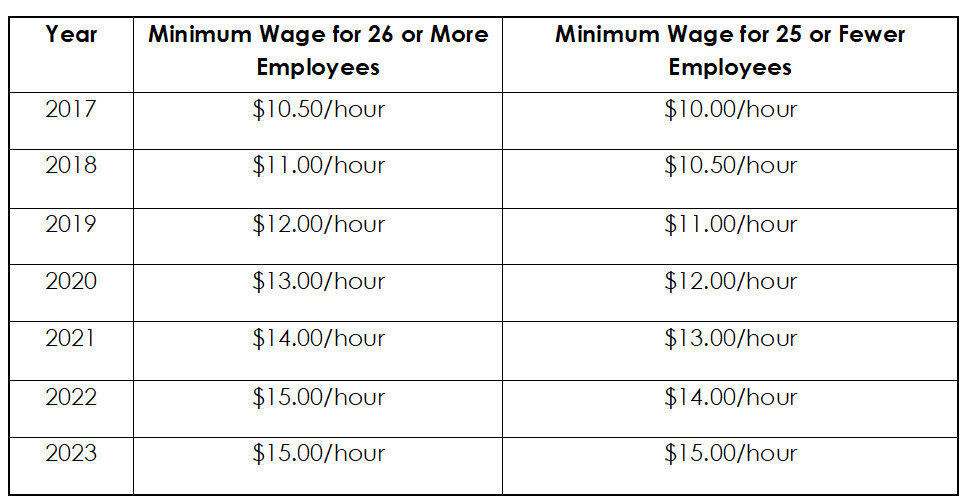

In 2016, the California State Legislature passed SB3, which set out a schedule for increasing the state’s minimum wage. The minimum wage law established a schedule for increasing the state’s minimum wage from the year of enactment through 2023. Thereafter, the minimum could be adjusted further depending on inflation. Also, many cities and counties in California have enacted their own minimum wage ordinances. As of the publication of this blog, the Los Angeles City and Los Angeles County minimum wage increases remain scheduled for July 1, 2020.

Failure to comply with the California minimum wage laws can be very costly for employers, yet understanding what constitutes compliance can be difficult when businesses are hit by unexpected events like a global pandemic. Learning which employers are bound by the law’s minimum wage requirements, how to identify eligible and exempt employees, and the consequences for lack of compliance can help your business avoid California minimum wage claims.

California Minimum Wage Laws: The Basics

The goal of SB3 was to raise the state’s minimum wage for all employees of California employers. The law set a six-year schedule, raising the minimum wage each year until the minimum wage for all California employees is $15 per hour.

In scheduling minimum wage increases, the law sets a different schedule based on the number of employees. The law increased the minimum wage annually at a faster rate for California employers with 26 or more employees than for those with 25 or fewer employees. SB3 scheduled minimum wage increases as follows:

Employers must be mindful of other minimum wage requirements, too. As some California communities have passed their own minimum wage ordinances, California employers must identify all applicable minimum wage laws and are bound to pay eligible employees the highest minimum wage required. For example, an employer based in one city may have to pay employees working – such driving or telecommuting — in another city the minimum wage of that city the employees are working.

Moreover, an employer and an employee may not agree to compensation for less than the legislated minimum wage in a written contract or collective bargaining agreement.

Defining “California Employers” under California Minimum Wage Laws

With regard to the new California minimum wage law, the first critical question for any business is determining whether your business is considered a California employer for purposes of the state’s minimum wage laws. This means a business registered in California may be considered a “California employer” even if it has little contact with the state. For example, a business may be considered a California employer even if it has only a single employee in the state or is headquartered elsewhere.

To avoid California minimum wage claims, any business with contacts in California, such as one or more employees or a physical presence in the state, should consult with a California employer attorney to verify whether the California minimum wage laws apply.

California Minimum Wage Eligibility and Exemptions

The next step for California employers is determining which employees are entitled to minimum wage. This evaluation requires considering the definition of “employee,” which was redefined effective January 1, 2020. The new test, set out by AB5, lists the considerations used to determine whether a worker is an employee or an independent contractor.

Once a business has identified which workers are employees, the minimum wage law has rather broad application. An employee’s age is irrelevant, making adult and minor employees equally eligible for minimum wage compensation. Further, employees who are “exempt” for purposes of California Labor Law are also covered by California minimum wage laws. The minimum threshold salary for exempt employees is two times the California minimum wage – which means every time the California minimum wage increases, so does the minimum amount an exempt employee must earn to retain exempt status. To be “exempt,” employees also must perform very specific exempt duties more than 50 percent of their working time. Their duties and salary control their exempt status, not their titles.

There are caveats for other categories of non-exempt employees as well. In certain circumstances, employers may pay less than the minimum wage to employees in these categories:

- Interns or other learning employees.

- Employees at organized camps.

- Certain employees whose earning capacities are impaired by disability.

Finally, there are also categories of employment that are not covered by California minimum wage laws at all. Following are examples of employees who are not covered by the minimum wage requirements:

- Employees in the employer’s immediate family (parent, spouse, child).

- Employees contracted as apprentices with work regulated by the California Division of Apprenticeship Standards.

- Outside salespersons (age 18 or older, regularly work more than half the time away from employer’s business, engaged in selling or obtaining orders for products or services).

The Cost of a California Minimum Wage Violation

California businesses must be in strict compliance to avoid California minimum wage claims. An employee alleging a violation of California minimum wage laws may file a wage claim with the California Division of Labor Standards Enforcement or a lawsuit in civil court. Employees have three years to file a claim alleging a violation of California minimum wage laws. That period may be extended to four years in certain circumstances.

Under California Labor Code § 1194, an employee who prevails in a minimum wage violation claim may be awarded the following:

- The full amount of wages owed.

- Interest.

- Reasonable attorney’s fees.

- Costs.

Even if you prevail in a minimum wage claim, your business will suffer its own costs in the form of attorney’s fees and workhours required to defend against the claim. Preventing minimum wage claims is the best defense.

The Best Way to Avoid California Minimum Wage Claims: Work with an Experienced Employer Attorney

California minimum wage is scheduled to change annually through 2023 and then as needed to keep up with inflation. Employers must satisfy multiple statutory requirements, including accurate evaluation and AB5 compliance in worker classification, in determining their minimum wage obligations. Navigating changing minimum wage requirements under state law as well as federal and local law is a full-time job.

To make sure you have the latest and most accurate information and advice to avoid California minimum wage claims, you need to partner with an experienced California employer lawyer like Susan A. Rodriguez and her team. For a consultation with the Law Offices of Susan A. Rodriguez, APC, call (213) 943-1323 or see our website at caemployerattorney.com.

Posted by Susan A. Rodriguez, Esq.

The information, comments and links posted on this blog do not constitute legal advice, and no attorney-client relationship has been or will be formed by any communication(s) with the blogger. Do not send any confidential or privileged information to the blogger. No information, documents or materials you send to the blog will be considered confidential or privileged by the Law Offices of Susan A. Rodriguez, APC or its lawyers and no information, documents or materials will be returned to you. If you do send any information, documents or materials to the blog, you give permission for the blogger to include them on or in the blog.

For legal advice, contact an attorney at Law Offices of Susan A. Rodriguez, APC or an attorney actively practicing in your jurisdiction.